Lacking Unique Stock Insights? Find and Focus Only on Critical Factors (Part 1 of 3)

If you wanted to fish for swordfish, chartering a deep water fishing boat with an experienced captain would be a sound strategy, but wouldn’t it be better to find a boat where the captain is known for having the customers who bring the biggest fish back to the dock? The best equity research analysts don’t just fish… they have a strategy that brings them to the target-rich area in order to reel in the biggest alpha-generating stock ideas. This may sound like common sense, but many analysts try to be an “industry” or “company” expert rather than a stock analyst, which prevents them from discovering alpha-generating insights.

As an equity research analyst, do you find your days jammed with meetings and calls and yet no killer insights? Are you torn between trying to be a mile wide and a mile deep (or a kilometer for our non-U.S. readers) in terms of your knowledge about your universe of stocks?

If you follow this framework you’ll be more effective with generating unique insights, modeling your companies, picking the right stocks and communicating your stock calls

If so, I hope you find value in applying this relatively simple concept of identifying and monitoring critical factors, which I’ve taught to hundreds of highly-successful buy-side and sell-side equity research analysts. If you follow this framework you’ll be more effective with generating unique insights, modeling your companies, picking the right stocks and communicating your stock calls.

During my career as an equity research analyst (which gave me the valuable opportunity to work with well over a thousand buy-side and sell-side analysts on four continents), I was always analyzing the elements that separated the good from the great. While there are many factors, the one that stood out the most was their ability to stay focused on just a few factors per stock.

In Best Practices for Equity Research Analysts and our AnalystSolutions workshops, we formalize this concept as an analyst’s ability to “identify and monitor a stock’s critical factors.”

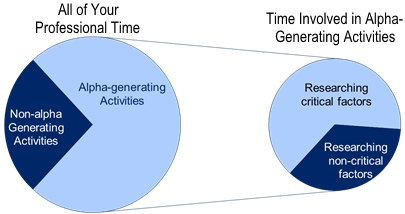

There are 2 pie charts below depicting the amount of time we have for equity research each day. (I know for some of you, it feels like a 24 hour pie.) Looking at the left pie chart below, almost every analyst would agree their goal is to maximize the amount of time they spend on alpha generating ideas. (Sell-side analysts also have a separate pie chart for generating client votes, but that’s a topic for another day.) Most analysts assume if they maximize their time in the light blue “alpha-generating” slice (such as calling industry information sources), they’ve succeeded. After all, if you participated in 5 conference calls, accepted 10 incoming phone calls and went to 3 meetings in a day, you filled it with all useful stuff and can go home knowing you’re a great analyst. But that’s the mistake too many analysts make…it doesn’t end by just focusing on alpha-generating activities. Instead, I find the best analysts maximize their alpha-generating-time to just 1-4 critical factors per stock (maximizing the light blue in the right pie chart).

Identifying and monitoring critical factors helps equity research analysts improve all aspects of their job. Using our GAMMA™ framework, here are some of the benefits:

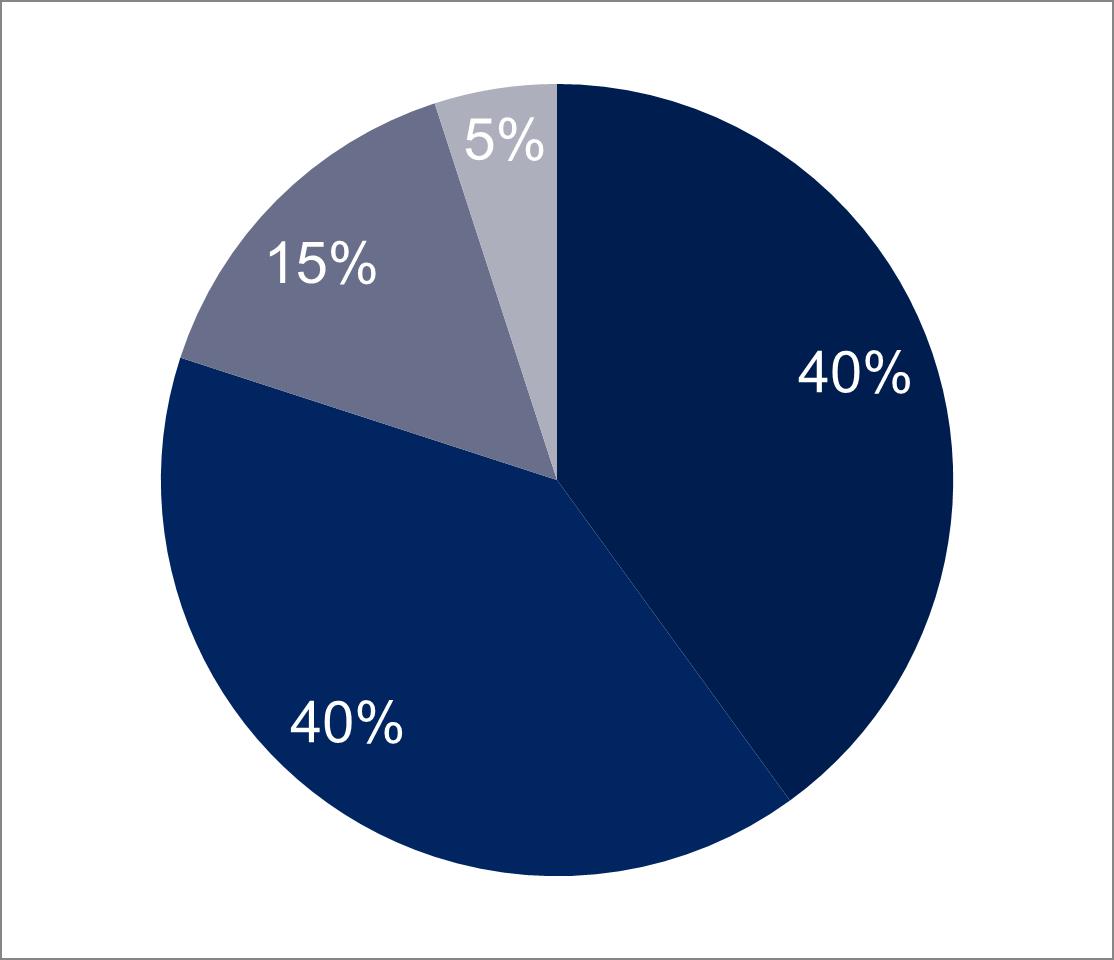

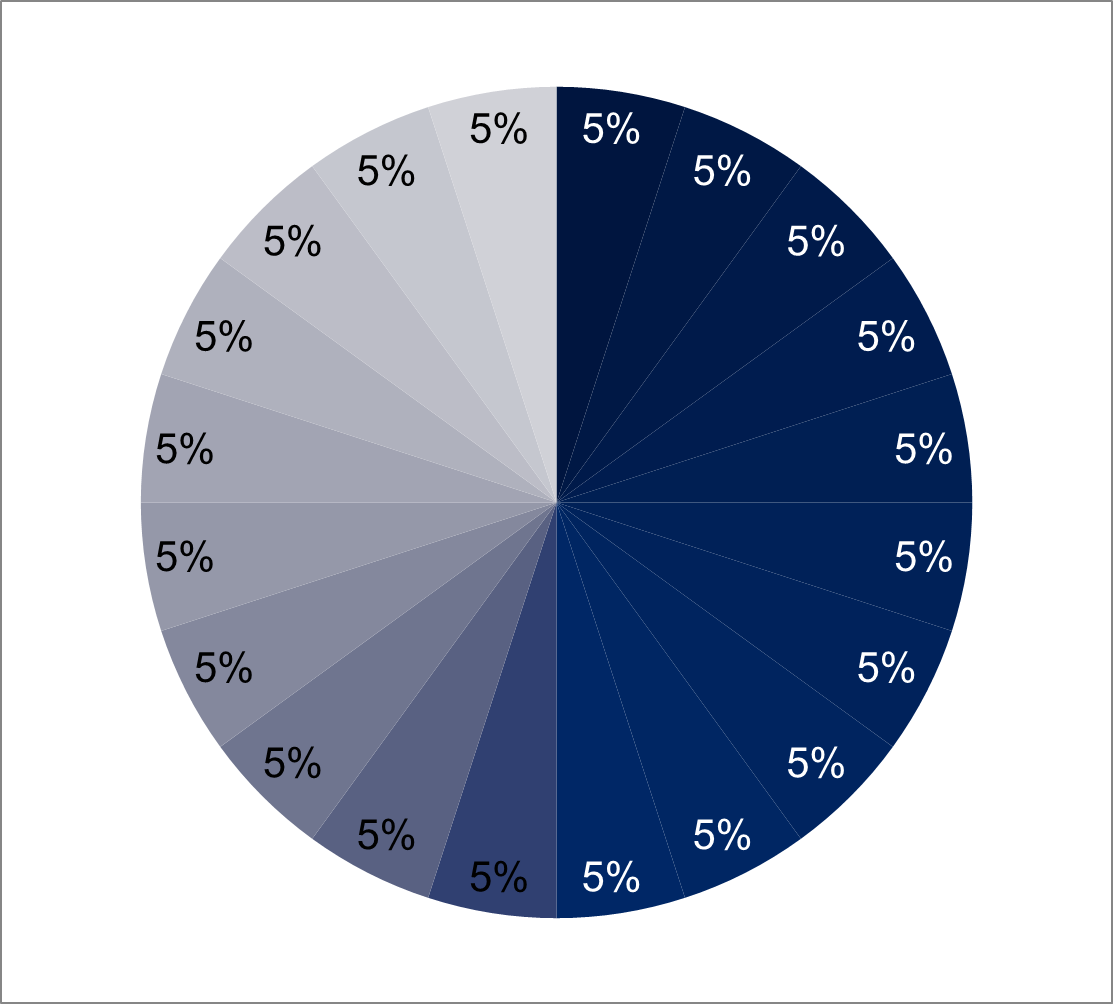

- Generate Informed Insights: It reduces the time wasted on “non-factors”, namely the market noise that is never going to move a stock, which frees up time to dig deeper than consensus to find unique insights. Let’s consider a scenario where there are two analysts: one who has taken the time to identify the critical factors for his stocks, and another who hasn’t. Let’s now assume 20 pieces of new information about their stocks cross the desks of both analysts during a given day. The analyst who hasn’t identified the critical factors, will spend approximately the same amount of time on everything, or about 5% per factor…

While the other analyst doesn’t waste time on the 16 elements that aren’t factors which allows him to dig deeply into a few factors most likely to move his stocks…

- Accurately Forecast: It determines where to spend time in a financial model…specifically in just the 1-4 areas where the critical factor is likely to impact results, thus removing the need to spend time on the other 10-100 lines of your earnings model.

- Make Accurate Stock Recommendations: Helps in determining the factor most likely to move a stock and its catalyst

- Motivate Others to Act (Communications): Keeps presentations and reports focused on just a few key areas

- Acquire Client Votes: For sell-side analysts, keeps them focused on helping clients where it matters

If you call or meet face-to-face with equity research analysts who routinely produce great insights for alpha-generating ideas, they can tell you immediately and succinctly the 1-4 critical factors likely to move their stocks during their investment time horizon. This may seem like common sense, but I find most analysts don’t have this short list consistently on their minds. Instead the overwhelming market noise or task of covering too many stocks restricts most analysts to being an inch deep (maybe a foot) in terms of knowledge about their stocks, preventing them from developing unique insights.

In the next Best Practices Bulletin™, I’ll return with Part 2 where I discuss the criteria to use to separate critical factors from all of the everyday factors. This link allows you to open an Excel spreadsheet that summarizes the process and use it with your stocks. Let me know if it helps and how I can improve upon this best practice.

This Best Practices Bulletin™ covers the following elements of our GAMMA PI™ framework:

#1. Generate Informed Insights

#2. Accurately Forecast

#3. Make Accurate Stock Recommendations

#4. Motivate Others to Act

#5. Acquire Buy-Side Votes

Visit our Resource Center to find more helpful articles, reference cards, and advice towards your growth as an Equity Research Analyst.

©AnalystSolutions LLP All rights reserved. James J. Valentine, CFA is author of Best Practices for Equity Research Analysts, founder of AnalystSolutions and was a top-ranked equity research analyst for ten consecutive years