10 Steps for Equity Research Analysts to Perform Better

According to Reuters, one of its sister companies, Lipper, finds that roughly 85% of active large-cap stock funds are lagging their benchmarks year-to-date through late November. Investors are voting with their feet as shown by the $206 billion of inflows into ETFs through the first 10 months of 2014 vs. only $36 billion for the larger actively-managed funds space.

I continue to preach that some of this problem is due to poor analysis by analysts. Not because the analysts are lazy or unintelligent, but because they don’t use best practices to generate superior stock calls.

Unlike most professions, an equity research analyst’s job is ill-defined. I use the analogy that the job is like someone attempting to read all of the books in the library…nobody can do it, so it comes down to who finds the best books to read and gets through them the fastest. Unfortunately, I find too many analysts don’t have much of a strategy so they simply start reading the first books they find (or those placed in front of them by the librarian). With this challenge in mind, I’m offering 10 steps you may want to consider to help find those best books, and get through them faster than your competition.

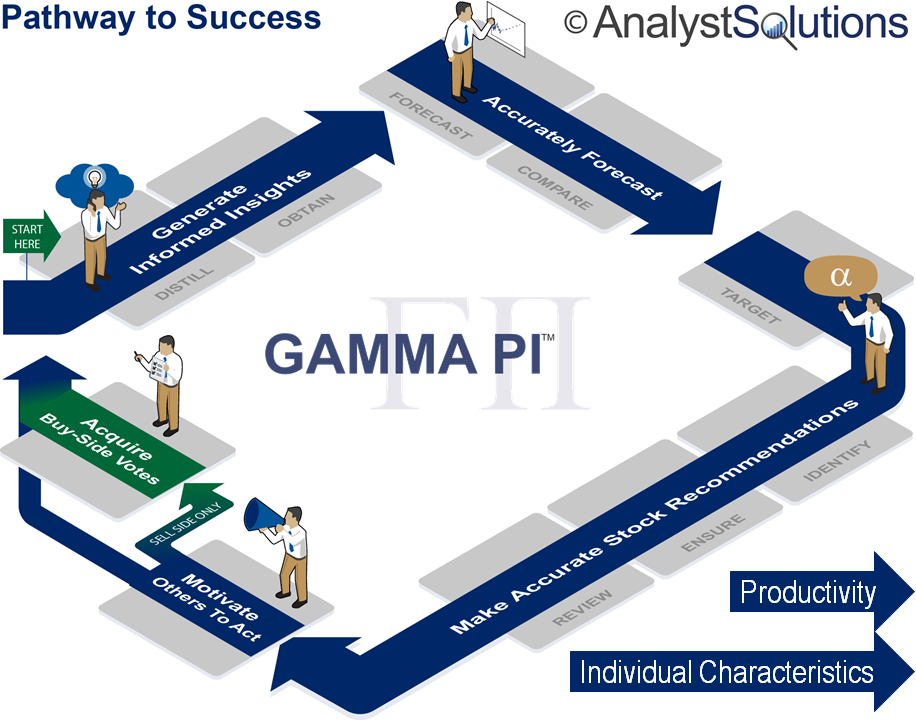

These steps are highlighted using our GAMMA PI™ framework (see image below), and provide the most important steps for each element.

By completing these 10 steps, you will use your time more productively, generate more alpha and get more recognition for your stock calls

Generate Informed Insights

1. Set aside time to identify the 1 to 4 critical factors for your highest profile stock and then stop being distracted by anything that’s not a critical factor for that stock (try to do this for one stock per week until you have a spreadsheet of all the critical factors for your universe of stocks).

2. Reach out to one new information source per stock in your universe. If you do this each week and half the contacts turn out to be helpful, you’ll have 25 new contacts by this time next year, giving you a huge competitive advantage

Accurately Forecast

3. For your highest profile stock call, create upside and downside scenarios to complement your base-case scenario, which will help to eliminate blind spots surrounding the question, “Where could I be wrong?” To keep it simple, create new assumptions around just the 1-3 most important critical factors for the stock (see an example here: AnalystSolutions Upside Downside Base-case Scenarios).

GAMMA PI™ Pathway to Success

Make Accurate Stock Recommendations

4. Review your worst stock call of the past year and ask which elements of our ENTER™ quality framework were missing: A) Was it Expectational (forward-looking)?; B) Was it Novel/New (presumably the market didn’t already have this information); C) Did you conduct Thorough research that resulted in an informed insight?; D) Would a trusted colleague have drawn the same conclusion if they Examined your work?; and E) Did you do enough research to Reveal where you could be wrong? The shortfall to almost all bad stock calls fall into one of these five areas above.

5. For your highest profile stock call (recent or present), ask if you followed the steps in our TIER™ framework: A) created a defendable price Target based on objective analysis of the stock’s valuation history; B) clearly Identified and forecast the catalyst that will bring the stock to your price target; C) Ensured you had found the ideal Entry point (not too early or too late); and D) Reviewed your performance and thesis periodically to ensure you exit at the optimal time.

Motivate Others to Act on Recommendations (aka “Communications”)

6. Review your last major research report or presentation and ask how you can make the next one better by using the elements of our ADViCE™ framework: A) Did you make others Aware of alternative scenarios and views, as well as adjustments to your thesis?; B) Did you explain how you Differed from the consensus thinking about the stock and its catalyst(s); C) Were your key points Validated with independent research?; D) Were you Conclusive about the stock(s) and catalyst(s)?; and E) Was it Easy to consume for the intended audience (could a disinterested PM review it and understand the stock call?)

Acquire Client Votes (for sell-side only)

7. For sell-side analysts, create a marketing plan for the upcoming year that includes the following: A) List of questions your smartest clients want answered via in-depth research (then do the research so you have something clients value); B) Target goals for your outgoing client interactions, by month; C) Locations for client-facing trips by quarter; and D) List of important firm clients with whom you want/need to strengthen relationships

Productivity

8. Put a 15-minute appointment on your calendar to recur every week at a quiet time (Friday afternoon, Sunday evening, etc.) to do the following: A) ensure your upcoming week has only events that help you generate unique insights or get your stock calls recognized; and B) Set goals for the insights you intend to generate in the upcoming week such as the specific information sources you intend to contact or critical factors you intend to research

9. Leverage these key technologies: A) continually refine your news alerts to filter out more noise; B) when researching company-generated information, review only what’s changed (e.g. FactSet’s Black Line reports) and read conference call transcripts rather than listen (or listen post call at 2x the speed); and C) use a note-taking application such as OneNote or Evernote to manage information effectively (i.e. review only once and have the ability to search and tag content)

Individual Characteristics

10. Take an assessment to determine your blind spots or weaknesses. We recommend our GAMMA PI™ assessment, which is the only one dedicated to assessing the role of an equity research analyst. If you’re looking for a general assessment, the Myers Briggs Type Indicator is arguably the most popular while the HoganLead assessment is helpful in finding the “derailers” that cause professionals to struggle in their jobs.

Conclusion

If you feel challenged to generate alpha or get recognized for your efforts, following these steps above should help. They won’t enable you to read every book in the library, but you should find the best books faster than your competition.

This Best Practices Bulletin™ covers all seven of the elements of our GAMMA PI™ framework.

Visit our Resource Center to find more helpful articles, reference cards, and advice towards your growth as an Equity Research Analyst.

©AnalystSolutions LLP All rights reserved. James J. Valentine, CFA is author of Best Practices for Equity Research Analysts, founder of AnalystSolutions and was a top-ranked equity research analyst for ten consecutive years